Stop wasting time on the wrong sales strategy. The choice between Account-Based Marketing (ABM) and volume-based outbound isn't about picking the "trendy" approach: it's about matching your strategy to your agency's economics and growth stage. Here's exactly how to make that call and execute it properly.

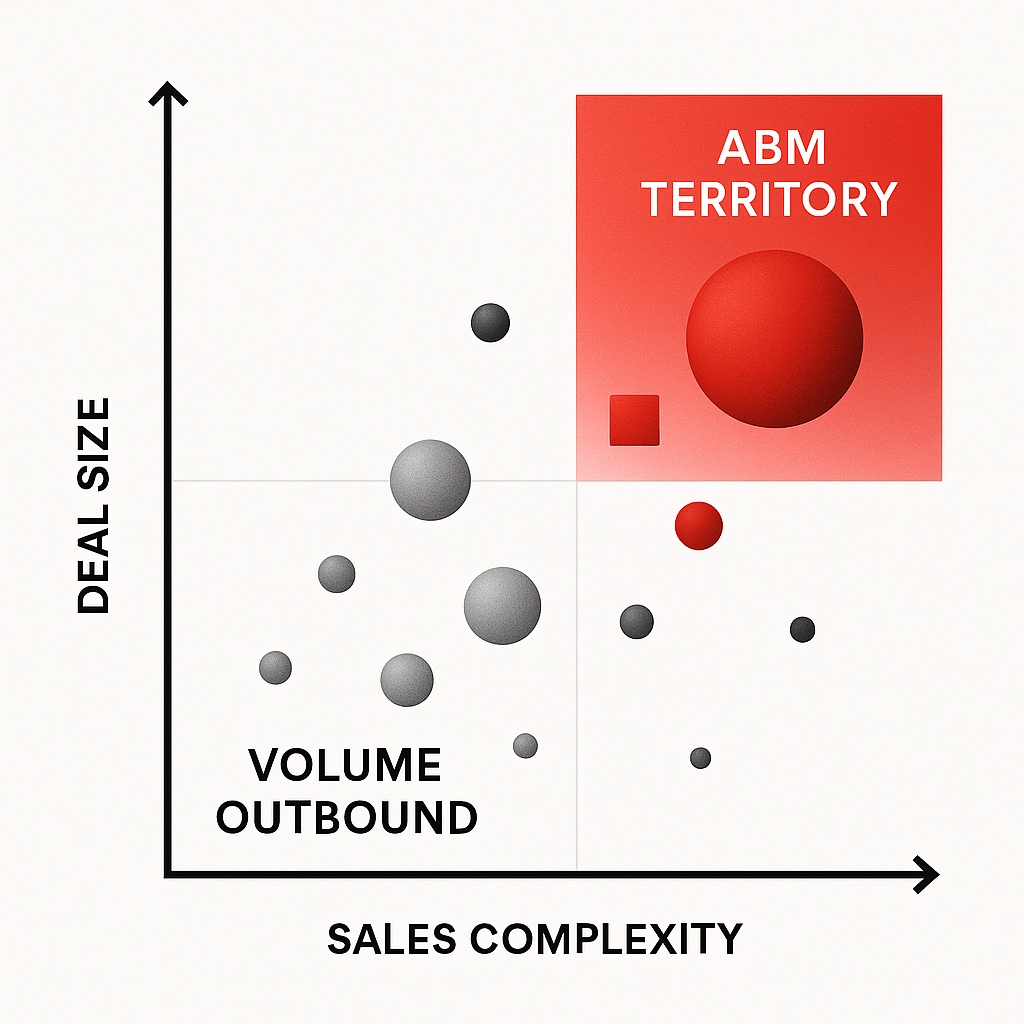

The short answer: ABM wins when you're targeting high-value accounts with complex buying processes, while volume-based outbound dominates for scalable lead generation with shorter sales cycles. But that's not the full story. The real winners in 2025 are using a strategic blend of both approaches based on deal size, market position, and internal resources.

Let me walk you through the decision framework I use with agency founders, then show you exactly how to implement whichever approach makes sense for your situation.

Understanding ABM: The Precision Revenue Engine

ABM isn't just "personalized outreach": it's a complete revenue strategy focused on fewer, higher-value accounts. Think of it as quality over quantity taken to its logical extreme.

Here's what ABM actually looks like in practice: You identify 50-200 target accounts, research each one extensively, and create highly personalized campaigns across multiple touchpoints. We're talking personalized videos, custom landing pages, industry-specific case studies, and coordinated outreach across multiple decision-makers within each account.

The ABM advantage shows up in three key areas:

First, conversion rates skyrocket. When you target accounts with $50K+ potential and personalize every interaction, you're seeing 2-3x higher response rates compared to generic outbound. I've seen agencies move from 2% email response rates to 8-12% with proper ABM execution.

Second, deal sizes increase dramatically. ABM naturally pushes you upmarket because the economics only work with larger contracts. You're not chasing $5K projects: you're landing $100K+ annual contracts that justify the investment in research and personalization.

Third, sales cycles accelerate despite the complexity. When you're speaking directly to specific pain points with tailored solutions, decision-makers engage faster. The research phase upfront pays off in shorter negotiations later.

When ABM Makes Strategic Sense

Deploy ABM when your agency meets these specific criteria:

Deal Size Threshold: Your average contract value exceeds $25K annually. Anything below this threshold makes the ABM investment difficult to justify. The sweet spot is $50K+ where the research and personalization costs become negligible compared to revenue potential.

Complex Buying Committees: You're selling to enterprises where 6-10 stakeholders influence decisions. ABM shines here because you can create tailored messaging for each role: technical content for engineers, ROI projections for CFOs, competitive analysis for executives.

Longer Sales Cycles: If your typical sale takes 3+ months, ABM's relationship-building approach pays dividends. You're not rushing to close: you're systematically building consensus across the buying committee.

Established Market Position: ABM works best when you have proven case studies, industry expertise, and the credibility to command premium pricing. If you're still figuring out product-market fit, start elsewhere.

Volume-Based Outbound: The Scale Machine

Volume-based outbound operates on completely different principles. Instead of deep research per account, you're creating systematic processes that can touch hundreds or thousands of prospects with minimal per-contact investment.

The mechanics look like this: You build prospect lists of 1,000+ contacts, create email sequences with light personalization (company name, industry, role), and measure success through volume metrics: responses per 1,000 emails, meetings booked per week, opportunities created per month.

Volume outbound excels in three scenarios:

Market Discovery: When you're testing new verticals or service offerings, volume approaches help you quickly identify which segments respond best. You can test messaging across different industries faster than ABM allows.

Pipeline Velocity: If you need to fill your pipeline quickly: say you're 60 days into the quarter and behind on targets: volume outbound delivers faster results. You can launch a campaign and start seeing responses within days.

Lower-Ticket Sales: For services under $25K annually, volume approaches make economic sense. The unit economics work when you're processing higher quantities of smaller deals.

The Decision Framework: Your Strategic Assessment

Now, let's determine which approach fits your agency. Work through this framework systematically:

Step 1: Calculate Your Break-Even Math

Take your average deal size and multiply by your close rate. If ABM costs you $500 per targeted account (research, content creation, personalization), what deal size makes this investment worthwhile?

Here's the calculation: If you're closing 15% of ABM targets and deals average $40K, your cost per closed deal is $3,333 ($500 ÷ 0.15). That's an 8.3% cost of acquisition: excellent for most agencies.

For volume outbound, if you're spending $50 per 1,000 emails and closing 0.5% at $15K average, your cost per deal is $1,000. That's a 6.7% cost of acquisition: also strong, but for smaller deals.

Step 2: Assess Your Team's Capabilities

ABM requires different skills than volume outbound. Do you have people who can:

- Conduct deep account research

- Create personalized content at scale

- Coordinate multi-channel campaigns

- Manage complex nurture sequences

Volume outbound needs:

- List building and data management

- Email deliverability optimization

- A/B testing and optimization

- High-volume follow-up systems

Step 3: Evaluate Market Positioning

ABM works when you have clear differentiation and proven results in specific verticals. Volume outbound succeeds when you can articulate value quickly to broad audiences.

The Hybrid Approach: Strategic Account Segmentation

Here's what most successful agencies actually do: they segment their market into tiers and apply different strategies to each.

Tier 1 Accounts (Top 10% of potential deals): Full ABM treatment with dedicated account plans, personalized content, and multi-stakeholder engagement.

Tier 2 Accounts (Next 20% of potential deals): "ABM-lite" with industry-specific messaging, some personalization, but standardized content frameworks.

Tier 3 Accounts (Remaining 70%): Volume-based outbound with basic personalization and automated follow-up sequences.

This segmentation lets you maximize efficiency across your entire addressable market without over-investing in low-potential opportunities or under-investing in high-value targets.

Implementation Roadmap: Getting Started

If You're Starting with ABM:

First, identify your ideal customer profile with surgical precision. Not "mid-market SaaS companies" but "Series B SaaS companies in fintech with 100-500 employees experiencing rapid scaling challenges."

Second, build your account list methodically. Start with 50 accounts maximum: you want to do this right, not fast. Research each account for recent funding, leadership changes, competitive landscape, and specific business challenges.

Third, create your content framework. You need industry-specific case studies, role-based value propositions, and channel-specific messaging. This isn't generic sales collateral: every piece should feel custom-built for your target accounts.

If You're Starting with Volume Outbound:

Begin with audience segmentation. Even in volume approaches, you need distinct messaging for different prospect types. Create 3-5 core segments based on industry, company size, or role.

Next, build your tech stack for scale. You need reliable email deliverability, CRM integration, and automation tools. Poor deliverability kills volume campaigns before they start.

Finally, establish your testing methodology. Volume outbound lives or dies on continuous optimization. Set up A/B testing for subject lines, messaging frameworks, and follow-up sequences from day one.

Measuring Success: The Right Metrics

ABM Success Metrics:

- Account engagement depth (multiple stakeholders responding)

- Pipeline velocity (time from first touch to opportunity)

- Deal size progression (average contract value growth)

- Account penetration (expansion within existing accounts)

Volume Outbound Success Metrics:

- Response rate consistency (maintaining quality at scale)

- Cost per opportunity (efficiency across channels)

- Pipeline volume (total opportunities generated)

- Conversion rate optimization (continuous improvement)

Making Your Strategic Choice

The agencies winning in 2025 aren't choosing ABM or volume outbound based on what's popular: they're matching their strategy to their business model, market position, and growth objectives.

If you're established with proven differentiation and targeting high-value accounts, ABM delivers superior results. The investment in personalization pays off through larger deals and faster sales cycles.

If you're scaling quickly, testing new markets, or working with smaller deal sizes, volume-based outbound provides the speed and efficiency you need.

Most likely, you'll end up with elements of both. The key is implementing each approach properly rather than trying to do everything at once. Start with whichever matches your current situation, execute it well, then layer in the other approach as your capabilities and market position evolve.

Choose your approach based on economics, not trends. Execute it systematically. Measure relentlessly. That's how you build a predictable revenue engine in 2025.