Agency acquisitions can catapult your business to the next level: or become expensive lessons in what not to do. After working with hundreds of agency founders through M&A processes, I've seen the same costly mistakes repeated over and over. The good news? Every single one is preventable.

Here's the reality: 92% of acquisitions fail to create shareholder value. But the agencies that get it right? They're building empires while their competitors struggle with organic growth limitations.

Let me walk you through the seven most damaging mistakes I see agency founders make during acquisitions, and more importantly, exactly how to fix them.

Mistake #1: Conducting Surface-Level Due Diligence

This is where most deals go sideways before they even close. You're excited about the revenue numbers and client roster, so you skim through the financial statements and call it a day. Big mistake.

I've watched agency owners discover post-acquisition that their "profitable" target was actually hemorrhaging money through hidden expenses, had major regulatory compliance issues, or relied entirely on one key employee who left immediately after the deal closed.

Here's how to fix it: Treat due diligence like surgery: precise, thorough, and methodical. Don't just review the pretty executive summary. Dig into these critical areas:

- Financial deep-dive: Go beyond P&L statements. Examine cash flow patterns, accounts receivable aging, and seasonal variations

- Legal obligations: Review all contracts, especially client agreements and vendor relationships

- HR practices: Audit employment agreements, benefits structures, and any pending legal issues

- Operational systems: Understand their tech stack, processes, and dependencies

- Regulatory compliance: Verify licenses, certifications, and industry-specific requirements

Allocate 60-90 days minimum for proper due diligence. If the seller is pushing for a faster timeline, that's a red flag worth investigating.

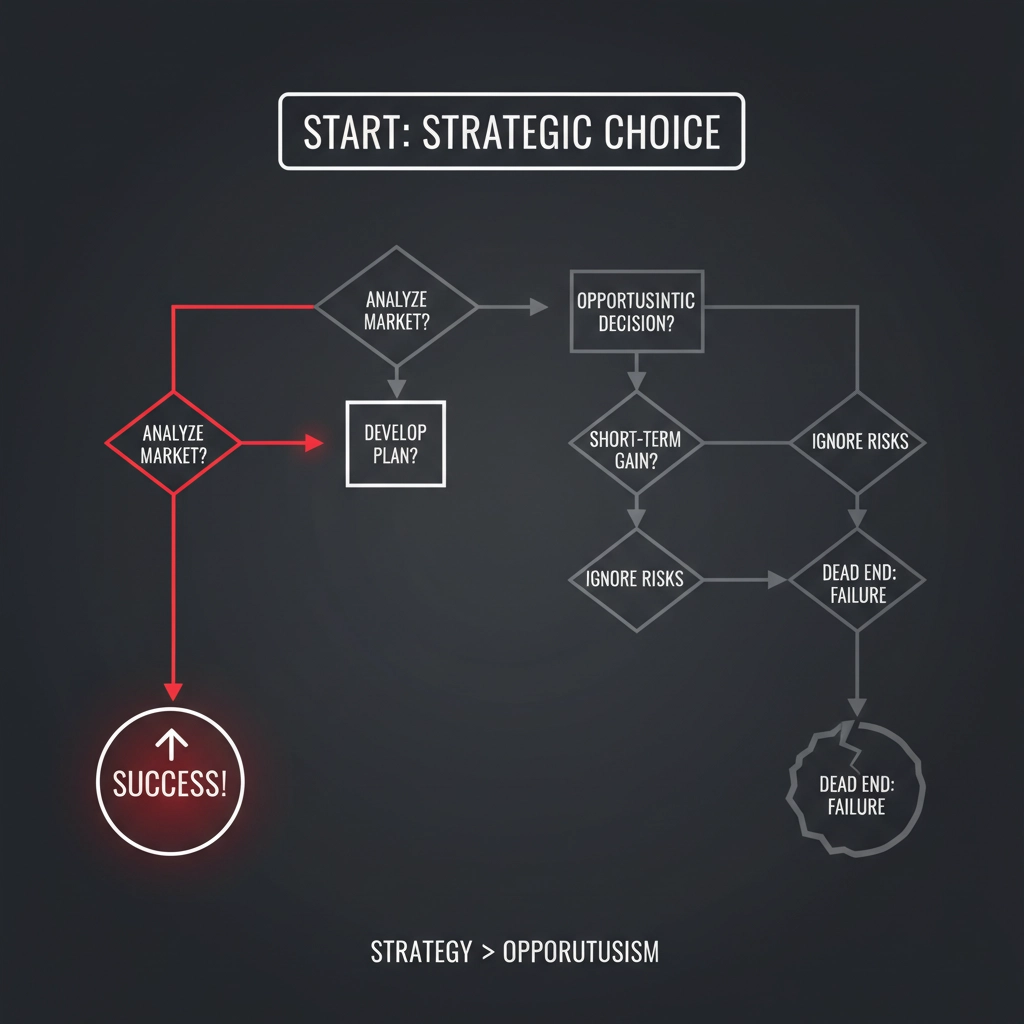

Mistake #2: Buying Without Strategic Vision

I see this constantly: an agency becomes available at an attractive price, and suddenly you're convinced it's the perfect acquisition. You're buying opportunistically instead of strategically, and that's a recipe for disaster.

Without clear strategic alignment, acquisitions become resource drains. You end up with a collection of disparate businesses instead of a cohesive growth engine.

Here's your fix: Start with strategy before you even begin looking for targets. Ask yourself these fundamental questions:

- What specific market share am I trying to capture?

- Which capabilities or specializations am I missing?

- How does this acquisition accelerate my 3-5 year vision?

- Can I achieve the same results through organic growth or partnerships?

Create a written acquisition thesis that outlines your strategic goals. Use this as your filter: if a potential target doesn't clearly advance these objectives, walk away regardless of how "good" the deal looks on paper.

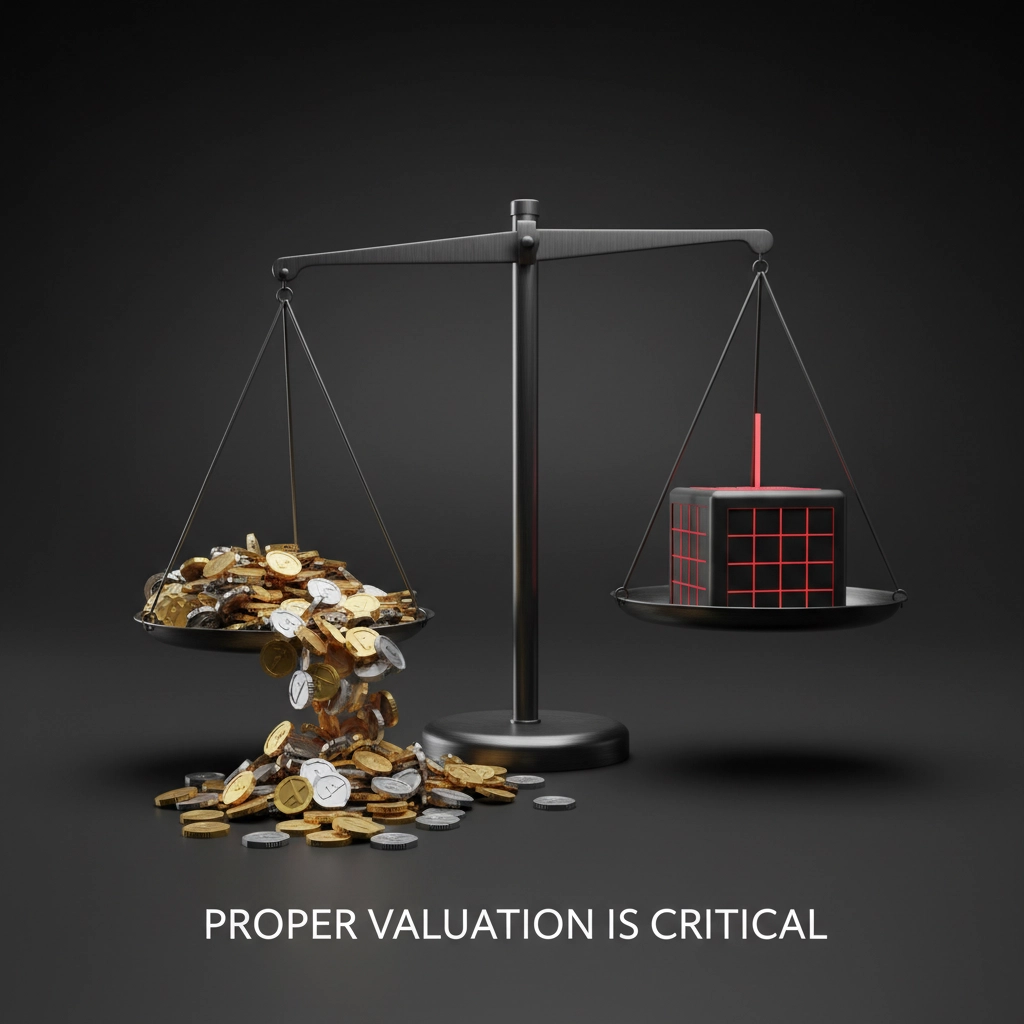

Mistake #3: Paying Too Much (Or Too Little)

Valuation mistakes happen in both directions, and both are costly. Overpay, and you're immediately behind on ROI with limited resources for growth investments. Underpay significantly, and you'll face resistance from the target team who feel undervalued.

The most common valuation error? Relying solely on revenue multiples without considering profit margins, growth trajectory, or market positioning.

Here's how to get valuation right: Use multiple valuation methodologies to triangulate fair value:

- Revenue multiple analysis: Compare to recent transactions in your market segment

- EBITDA multiple approach: Focus on sustainable profitability, not just top-line growth

- Discounted cash flow: Model future cash flows based on realistic growth assumptions

- Asset-based valuation: Consider the value of client relationships, IP, and team capabilities

Get third-party validation from an M&A advisor or valuation specialist. Their objective perspective often prevents emotional decision-making that leads to overpayment.

Mistake #4: Poor Communication Throughout the Process

Acquisitions create uncertainty, and uncertainty kills productivity and retention. I've seen promising deals collapse because key employees jumped ship during the process, taking clients with them.

The problem? Most buyers treat communication as an afterthought instead of a strategic priority. They focus on legal and financial details while their future team spirals into anxiety about job security and culture changes.

Here's your communication blueprint:

Start communication planning before you make an offer. Develop messaging that addresses these critical concerns:

- Why this acquisition makes strategic sense

- How current employees fit into the future vision

- What will change and what will stay the same

- Timeline for integration decisions

Hold regular all-hands meetings during the process. Be transparent about timelines and decision-making criteria. Address concerns directly instead of hoping they'll resolve themselves.

Create a dedicated communication channel (Slack, email list, or regular meetings) for ongoing updates. Uncertainty breeds rumors, and rumors destroy deals.

Mistake #5: Ignoring Cultural Integration

Culture clashes are silent deal killers. Two profitable agencies can create a dysfunctional nightmare when their cultures don't mesh. I've watched successful acquisitions turn into talent exodus stories because the acquiring agency assumed culture would "figure itself out."

Your cultural integration strategy:

Before the deal: Spend time with their team in their environment. How do they communicate? What are their core values? How do they handle client relationships and internal conflicts?

During negotiation: Identify potential cultural friction points early. Are they formal while you're casual? Do they prioritize different metrics or work styles?

Post-acquisition: Don't force immediate cultural assimilation. Instead, identify shared values and build from there. Create cross-team projects that showcase the best of both cultures.

Plan cultural integration activities that feel authentic, not forced. Team retreats, joint training sessions, or collaborative client projects can bridge cultural gaps naturally.

Mistake #6: Rushing the Timeline

Sellers often create artificial urgency ("I have three other interested buyers"), and buyers fall for it. Rushing leads to missed red flags, poor integration planning, and costly oversights.

The discipline of proper timing: Great acquisitions require methodical planning. Here's your realistic timeline:

- Initial evaluation: 2-4 weeks

- Due diligence: 60-90 days

- Integration planning: 30-45 days (concurrent with due diligence)

- Legal documentation: 30-60 days

Resist pressure to compress these timelines. If a seller won't accommodate proper due diligence, question whether they're hiding something or if other buyers are making uninformed decisions.

Use the time productively. While your legal team handles documentation, focus on integration planning with your operations team.

Mistake #7: No Post-Acquisition Growth Strategy

This is where most "successful" acquisitions actually fail. You close the deal, celebrate, and then realize you have no plan for growing the combined entity. Client attrition is inevitable: if you don't have a growth strategy, you'll watch your investment shrink.

Your post-acquisition growth framework:

Month 1-3: Focus on retention and stabilization. Ensure client relationships transfer smoothly and key team members feel secure.

Month 4-6: Implement your growth initiatives. This typically means ramping up marketing efforts to offset natural client attrition and capitalize on increased capacity.

Month 7-12: Execute cross-selling opportunities and service expansion plans you identified during due diligence.

Budget for increased marketing spend immediately. No agency has 100% client retention, so you'll need additional marketing resources to cover natural attrition from your increased client volume.

Plan your team expansion carefully. Don't hire rapidly just because you can afford it. Strategic hiring that fills capability gaps is more valuable than headcount growth for its own sake.

Putting It All Together

Successful agency acquisitions aren't about finding the "perfect" target: they're about executing a disciplined process that minimizes risk while maximizing strategic value.

Here's your action plan:

- Define your acquisition strategy before you start looking

- Budget 6+ months for the complete process from initial contact to integration

- Invest in professional support: M&A advisors, attorneys, and integration specialists pay for themselves

- Communicate relentlessly with all stakeholders throughout the process

- Plan integration activities during due diligence, not after closing

The agencies crushing it with acquisitions aren't necessarily smarter: they're more disciplined. They follow proven processes instead of winging it, and they invest the time and resources needed to do deals right.

Your next acquisition could be the catalyst that transforms your agency from a lifestyle business into a market leader. Just make sure you're building on a foundation of strategic discipline, not hope and good intentions.

Start with strategy, execute with precision, and you'll join the small percentage of acquirers who actually create lasting value from their deals.